What's the Secure Horizons Process

- seanbolen0

- Sep 30, 2025

- 2 min read

Why We Think Differently

At Harbour View Advisors, we don’t believe retirees should settle for the “traditional wisdom” Wall Street has been selling for decades. We deliberately challenge conventional thinking when it puts our clients’ retirement security at risk.

Why We Reject the 60/40 Portfolio

For years, the industry has pushed the “balanced” 60/40 portfolio as the gold standard. But in today’s world of a changing bond landscape, market volatility, and longer retirements, this outdated formula leaves clients exposed. We believe in protecting first and building plans that secure income and minimize downside.

Why Ignoring Long-Term Care Is a Mistake

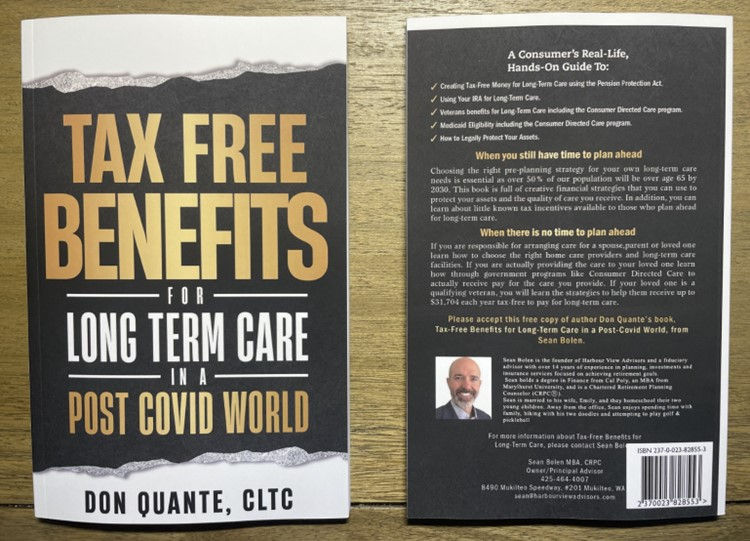

Most advisors sidestep the reality of long-term care. But the truth is, ignoring it can devastate even the best-laid retirement plan and wipe out a lifetime of savings or burden your loved ones.

Why Tackling Taxes Matters Just as Much as Investments

Too many advisors treat taxes as an afterthought. We believe that’s backwards. Retirement is not just about what you make, it’s about what you keep. By addressing taxes proactively, we help clients reduce lifetime tax exposure, keep more of their wealth working for them, and create a smoother legacy transfer for their families.

Why Cash Flow Needs Guardrails

Spending in retirement is not a straight line—it changes with markets, health, and lifestyle. We don’t just “project” retirement income; we build cash flow plans with guardrails. This means your plan adjusts responsibly over time, keeping you protected in down markets while allowing flexibility in strong years. It’s a practical, disciplined way to enjoy your retirement with confidence.

Why Spousal Survivorship Planning Is Non-Negotiable

Too many plans fail to account for what happens when one spouse passes away. We believe survivorship planning is essential—ensuring that income, Social Security, pensions, and healthcare remain secure for the surviving spouse. Our approach protects the family, not just the portfolio.

Estate Planning (Trusts/Wills)

We help organize and protection planning for yourself, your spouse and your legacy

Comments